Skip to main content

Charitable Lead Trust

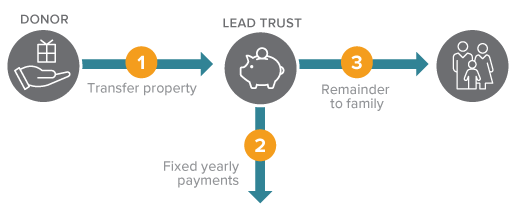

How It Works

- You contribute securities or other appreciated assets to a Charitable Lead Trust. Our suggested minimum gift is $1,000,000.

- The trust makes annual payments to Academy Prep Center of St. Petersburg for a period of time.

- When the trust terminates, the remaining principal is paid to you or heirs.

Benefits

- Income payments to us for a term reduce the ultimate tax cost of transferring an asset to your heirs.

- The amount and term of the payments to Academy Prep Center of St. Petersburg can be set so as to reduce or even eliminate transfer taxes due when the principal reverts to your heirs.

- All appreciation that takes place in the trust may go tax-free to the individuals named in your trust.