Giving from Your 401k or IRA Retirement Plan

You've worked hard and planned for retirement. Now, with a little creativity, you can leverage your retirement assets to benefit you and your family, reduce federal taxes, and support Academy Prep Center of St. Petersburg far into the future.

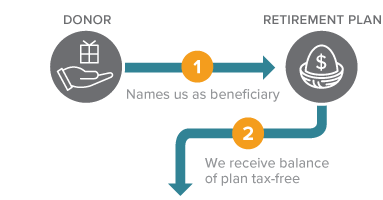

How It Works

- Name or designate Academy Prep Center of St. Petersburg as a beneficiary of your IRA, 401(k), or other qualified retirement plan.

- Pass the balance of your retirement assets to Academy Prep Center of St. Petersburg by contacting your plan administrator.

- Important! Tell Academy Prep Center of St. Petersburg about your gift. Your plan administrator is not obligated to notify us, so if you don't tell us, we may not know.

Benefits

- Continue to take regular lifetime withdrawals.

- Maintain flexibility to change beneficiaries if your family's needs change during your lifetime.

- Your heirs avoid the potential double taxation on the assets left in your retirement account.

Next

- More detail on retirement plans.

- Frequently asked questions on retirement plans.

- Contact us so we can assist you through every step.